AMD’s ZT Systems Acquisition: A Talent Grab or a Move to Disrupt Nvidia’s Data Center Monopoly?

In past articles, we’ve looked at NVIDIA’s NVL72 and its impact On the AI Data Center Ecosystem. To compete with NVIDIA’s NVL72, AMD needs to develop similar rack-scale solutions that integrate multiple GPUs and CPUs effectively with other key elements such as the server to server switches, interconnects, cooling and power management. All these elements come together to create an extremely powerful distributed compute platform which is necessary for where the future of compute is going towards. ZT Systems can provide the necessary expertise in designing and deploying these systems.

On August 19, 2024, AMD announced its plans to acquire ZT Systems, a server maker, for $4.9B. Based on AMD's recent earnings transcript, the key reason for acquisition is this will enable AMD to offer more comprehensive, optimized rack-scale solutions, which are essentially monopolized by NVIDIA.

Our clients have been buzzing with many questions as to the implications of this acquisition and we even presented at an investor teleconference on this exact topic. For example:

is the ZT Systems acquisition a sign that chip manufacturers are squeezing margin and differentiation capability from server manufacturers ?

is ZT Systems similar to Mellanox when it was acquired by Nvidia?

Is this deal just an "acquihire" — where AMD is mainly after ZT Systems' talent — or is it a bold move to create real competition for NVIDIA’s rack level products?

In this article, we will touch on:

AMD / ZT Transaction Summary. Why AMD chose ZT? Why Now?

Timeline for Integration and Alignment with AMD’s Roadmap

Which Companies Will be Impacted?

Acquihire or Real Competition for Nvidia?

Please note: The insights presented in this article are derived from confidential consultations our team has conducted with clients across private equity, hedge funds, startups, and investment banks, facilitated through specialized expert networks. Due to our agreements with these networks, we cannot reveal specific names from these discussions. Therefore, we offer a summarized version of these insights, ensuring valuable content while upholding our confidentiality commitments.

AMD / ZT Transaction Summary. Why AMD chose ZT? Why Now?

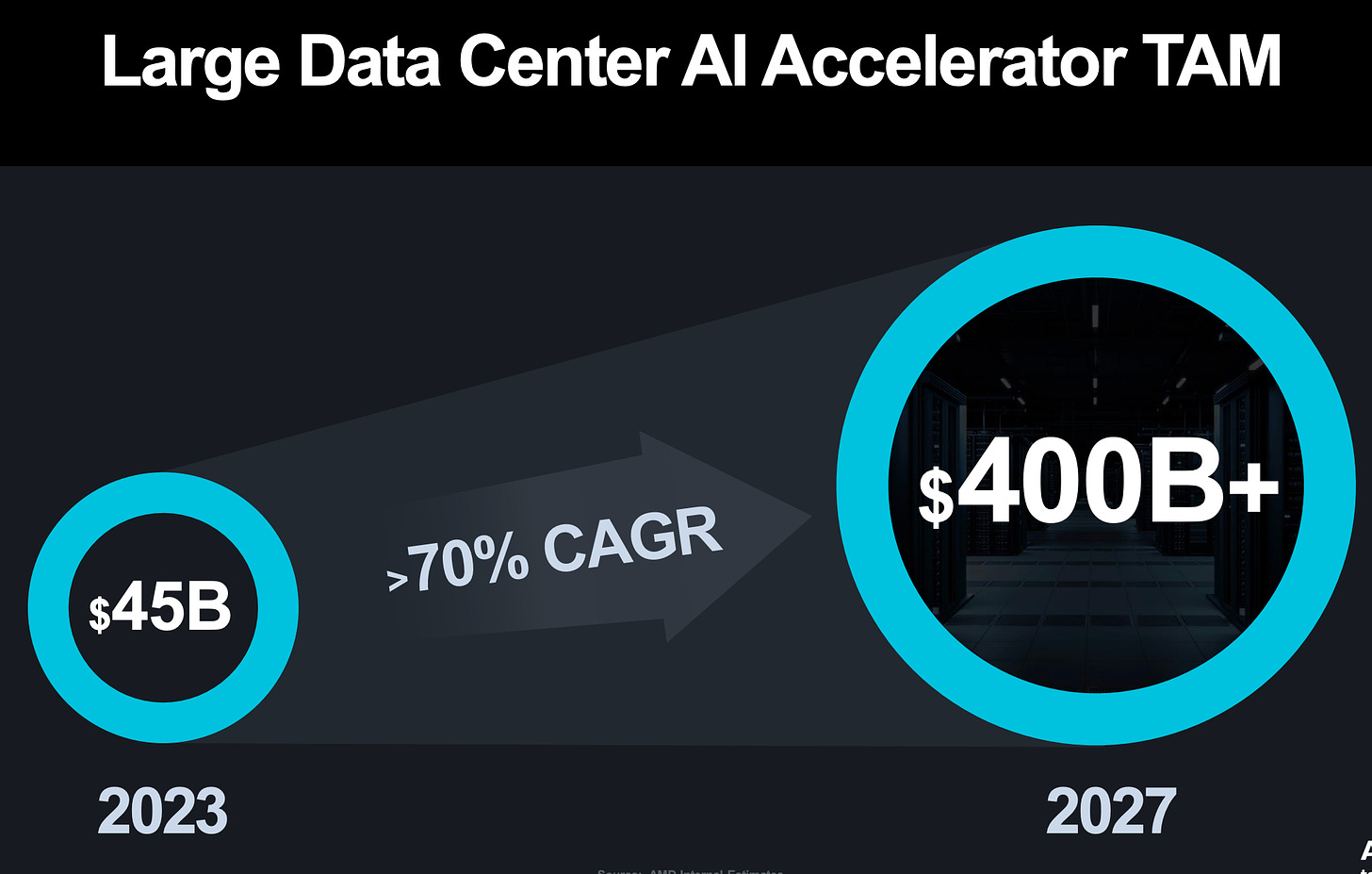

The Total Addressable Market (TAM) for data centers is projected to reach $400 billion by 2027, reflecting a significant CAGR driven by the growing demand for cloud computing, AI workloads, and edge computing. AMD CEO Lisa Su emphasized that the company has been making substantial investments in its long-term AI strategy to capture a share of this expanding $400 billion TAM, positioning AMD to capitalize on the rapidly evolving data center landscape.

Source: AMD Investor Presentation